|

Article ID: 2659

Last updated: 29 Mar, 2022

Your tax returns are still present within your folder structure. The practice version of TaxCalc utilises a database to store your data instead of individual tax return files. You simply need to import your returns into the database. Locate your Tax return files.Before starting ensure you know the location of all returns you wish to import. If unknown please search your computer for the following file extensions to locate all returns.

To search for a specific tax year add the year to the end of the file extension as in the example above. Import Tax returns into your TaxCalc database.

Please note that you cannot import prior to 2011/12. For earlier returns a tax year specific program was released. For further information refer to our Knowledge Base article Moving older versions of TaxCalc to a new PC (Individual customers)

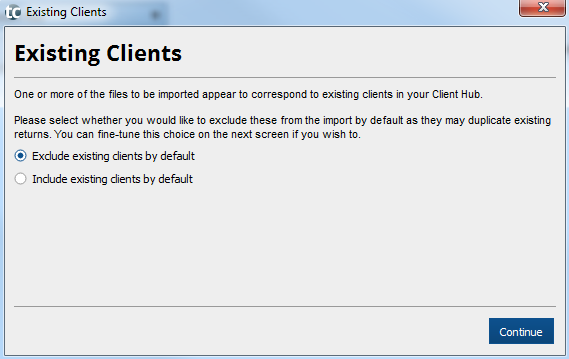

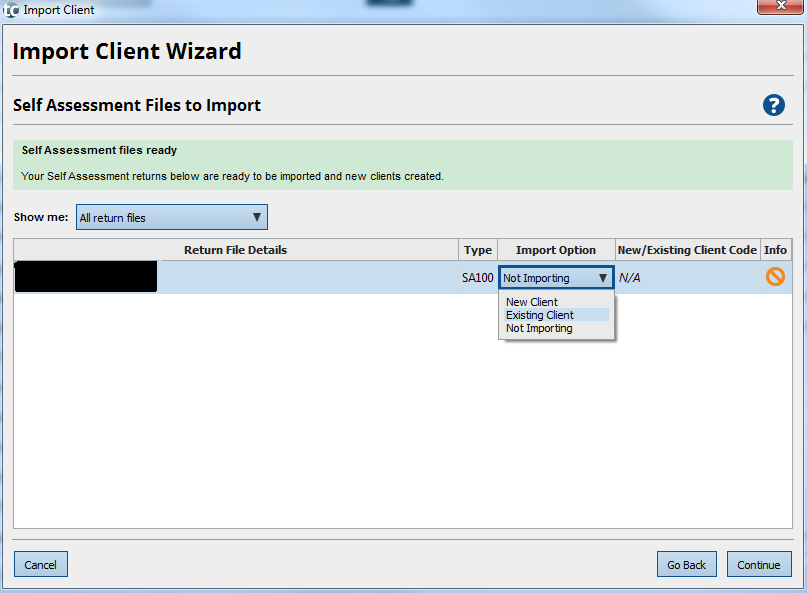

PLEASE NOTE - This window will only appear if the client contact already exists in the database. Exclude existing clients - This will skip the importation of any returns where the client contact already exists in Practice Manager. To be determined as an existing client a tax return does not need to be present. Include existing clients - This will import all selected returns regardless of the client contact existing or tax returns for the same year being present. All returns will be imported with the original (pre-existing) return being set as the main return for that tax year. If you are unsure which return contains the latest information, it is advisable to select Include existing clients this will import all returns and allow you to review and delete any redundant returns.

Repeat the steps above for other tax years.

It is highly recommended that you keep the default option to 'Store in database'. This will ensure all your data is held in a single database file which aides database integrity.

Take a backup of the database once you have completed the process in case a restore is required. For information on how to do this please refer to the Knowledge Base article on: How do I back up the database? Related Knowledge Base articles that you may find helpful;

This article was:

|

||||||||||||||||||||||||||||||||||

.png)

.PNG)

.PNG)