|

Article ID: 3375

Last updated: 06 Feb, 2025

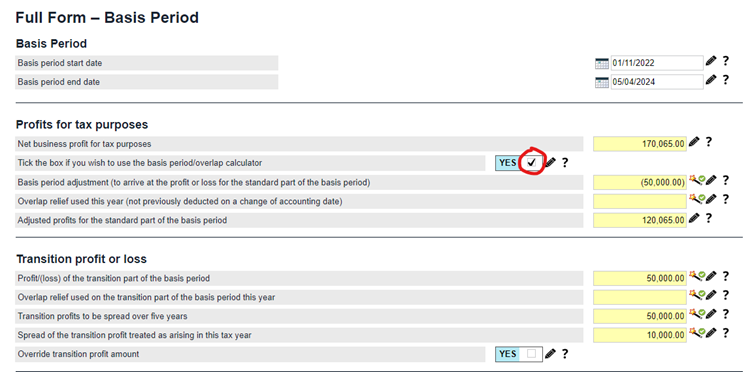

Basis Period Entries in TaxCalc (transitional year 2023/24)This article explains the entries to make for the 2023/24 transitional year. HMRC's business manual explains the rules, if you need to familiarise yourself before starting your entries in TaxCalc. You can either enter the adjustments manually or use the basis period calculator to:

You will find the basis period entries to make and the calculator in the SA100 in: SimpleStep mode: Your work > Self Employment > Full Form > Basis Period or HMRC Forms mode: Self Employment > Full Form > Page 4 > Under box 69 SimpleStep mode: Your work > Partnership Management > Partnership - Full Form > Basis Period or HMRC Forms mode: Partnership Management > Partnership - Full Form > Page 1 > Under box 12 What steps will I need to take in TaxCalc:We'll use the following example to demonstrate the entries to make:

Date your books or accounts start = 01/11/2022 Date you books or accounts are made up to = 05/04/2023 (or 31/03/2023)*

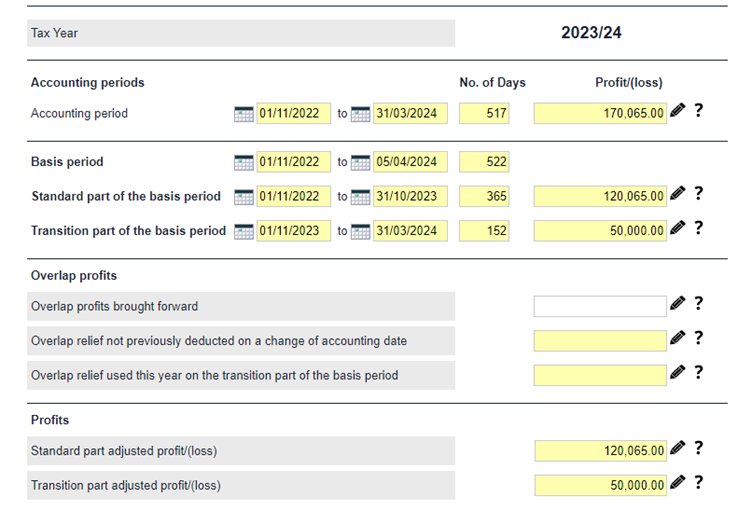

The Basis Period Calculator will display the full year profit and will apportion into the standard part of the year (01/11/2022 to 31/10/2023) and the transition part of the year (01/11/2023 to 31/03/2024).

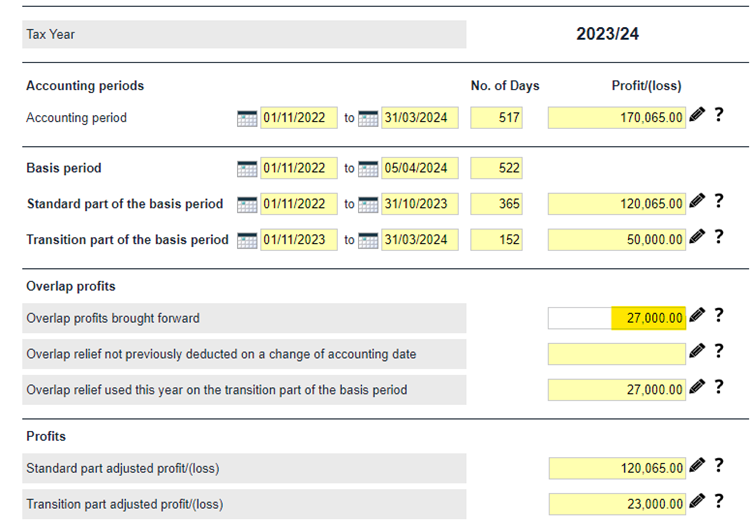

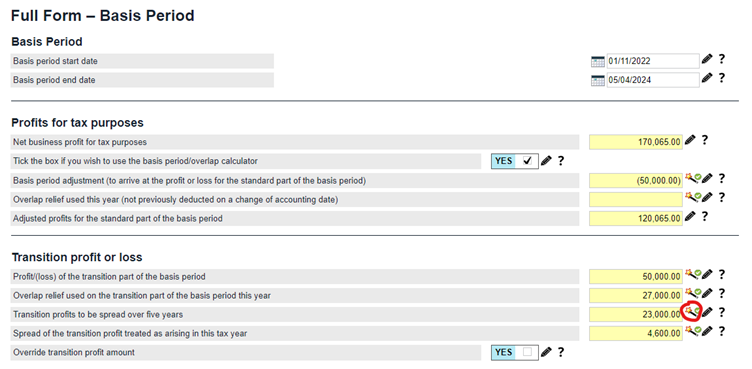

You will note that the overlap profits have been deducted from the transition part of the profits. You will also see that the box ‘overlap relief not previously deducted on a change of accounting date’ is not available for entry and this is because it is for overlap profits that could have been claimed before due to a change of accounting date and therefore can only be claimed when there is a standard basis period only (tax year basis). Close this screen and the Basis Period screen is displayed. What if I want to increase the transition profit being taxed this year?

The Transition Profit Calculations screen will display. Enter an amount in ‘Additional amount taxable this year (election to accelerate)’ :

You will notice that the overall transition profit has been adjusted to allow for reduced transition profit over the next four years, i.e. the additional £1,000 has reduced the transition spread amount by £250 in the following four years. Therefore, with this overpayment, next year’s portion of transition profits will be £4,350 (£17,400/4). The untaxed transition profits will be carried forward to next year. We will be providing a summary in the subsequent four years which will provide a breakdown of transition profits and amounts already charged to tax. We have used a basic scenario in this example to explain the concepts, but if you have different profit and/or loss scenarios, please check HMRC's Business Manual 81360 which provides extensive examples.

This article was:

|

||||||||||||

.png)