|

Article ID: 1211

Last updated: 20 Apr, 2023

TaxCalc can import data from previous tax years (for example TaxCalc 2022) from the tax return files so that you don't need to enter the same information for 2023 onwards. When you import a client using a tax return file, you're doing two things:

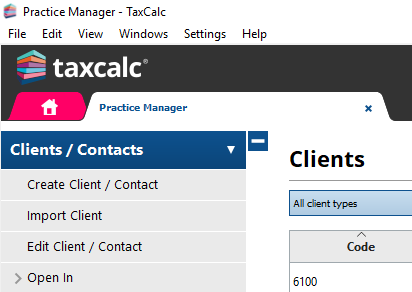

This process doesn't automatically create any tax returns. You must do that after you've imported the clients. Step 1: Open Practice ManagerWhen TaxCalc opens, launch Practice Manager from the home screen. Step 2: Start the Import Client ProcessWhen Practice Manager opens, it will look similar to the screen below. Select Import Client from the left-hand menu. The Import Client Wizard will then open, click continue to the introduction. Step 3: Use the Import Client WizardSelect the applicable tax year from the drop down menu - this example will show you TaxCalc 2022 (2022-23 year) file.

Click on Continue. Click on Choose next to Select a Single File to import….

Select the return you want to import.

Click on Open. This will return you to the Import Client Wizard. The file path to your selected file is now displayed and the return file details are now populated (in this case with a single SA100 return).

Click on Continue. The Files to Import screen confirms the type of files to be imported (in this case, Self Assessment).

Click on Continue. The next screen summarises the files to be imported. By default, the tax return will be stored in the TaxCalc database for future use. This is strongly recommended. If you want to store the return elsewhere, click on Keep in my file system.

Click on Finish. The imported client has now been added to the client database and will appear in any list of clients.

This article was:

|

|||||||||||||||||

.png)

.png)

.png)

.png)

.png)

.png)