|

Article ID: 911

Last updated: 25 Mar, 2025

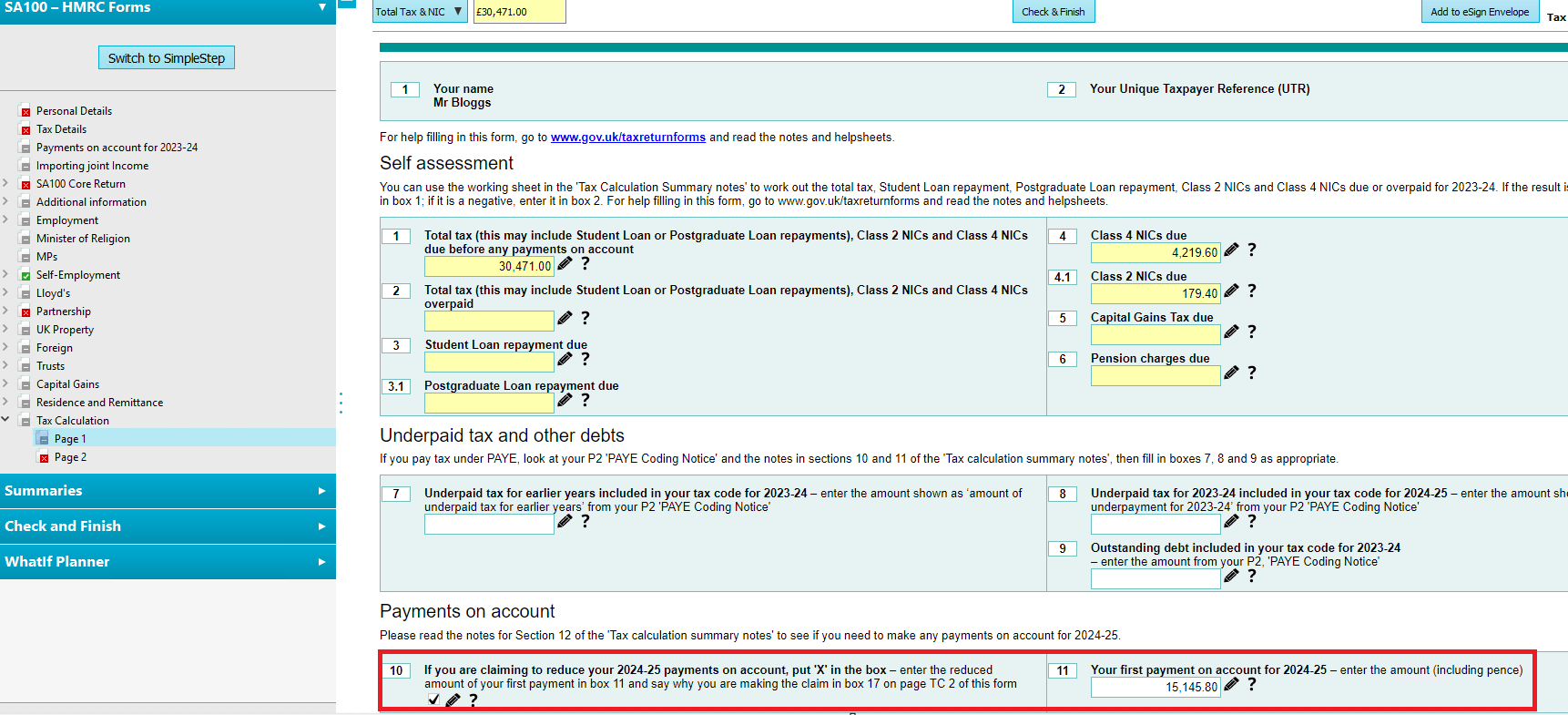

You can't increase payments on account towards the following tax year – you can only reduce them. You can choose to pay more on account, but HMRC will only ask for the payment on account calculated in your statement. To reduce payments on account, please follow the below instructions: HMRC Forms:Tax Calculation > Page 1 > Tick box 10 enter the new amount in box 11

Simple Step Mode:2024-25 Working out your tax > Tax Due > tick the box 'You can claim to reduce the payments on account. You should do this if your profits or income are not likely to be the same as the amounts shown in 2024-25. If you wish to claim to reduce your payments on account, please tick this box' > enter the new amount in the box titled 'please enter the reduced amount of your first payment'.

2023-24 and prior Working out your tax > Tax Due > tick the box 'You can claim to reduce the payments on account. You should do this if your profits or income are not likely to be the same as the amounts shown.....' > Enter the amount in box 'Please enter reduced amount of your first payment' and enter the reason why you are reducing your payments on accounts in the box provided. PLEASE NOTE: If you reduce the payments on account to be lower than the following year's tax liability, you or your client can be charged interest if there is a balancing payment remaining. Example: You need to complete the above information on 2023-24 tax return to reduce payments for 2024-25. If you've already submitted your tax return, you can post the SA303 form (claim to reduce payments on account) to HMRC.

This article was:

|

||||||||||

.png)