|

Article ID: 3382

Last updated: 25 Nov, 2025

Merged Research and Development Expenditure Credit (RDEC) scheme from 1 April 2024 For Corporation tax accounting periods beginning on or after 1 April 2024, a new merged Research and Development Expenditure Credit (RDEC) scheme is available for eligible trading companies within the charge to UK Corporation Tax. For companies that do not meet the definition of R&D intensive SMEs, this ‘new’ RDEC will be the main method of obtaining relief for R&D. The ‘new’ merged RDEC scheme is similar to the ‘old’ RDEC scheme that was available to large companies and for R&D subcontracted to SMEs for periods prior to 1 April 2024. The key differences between the ‘old’ RDEC scheme and the ‘new’ RDEC scheme are as follows;

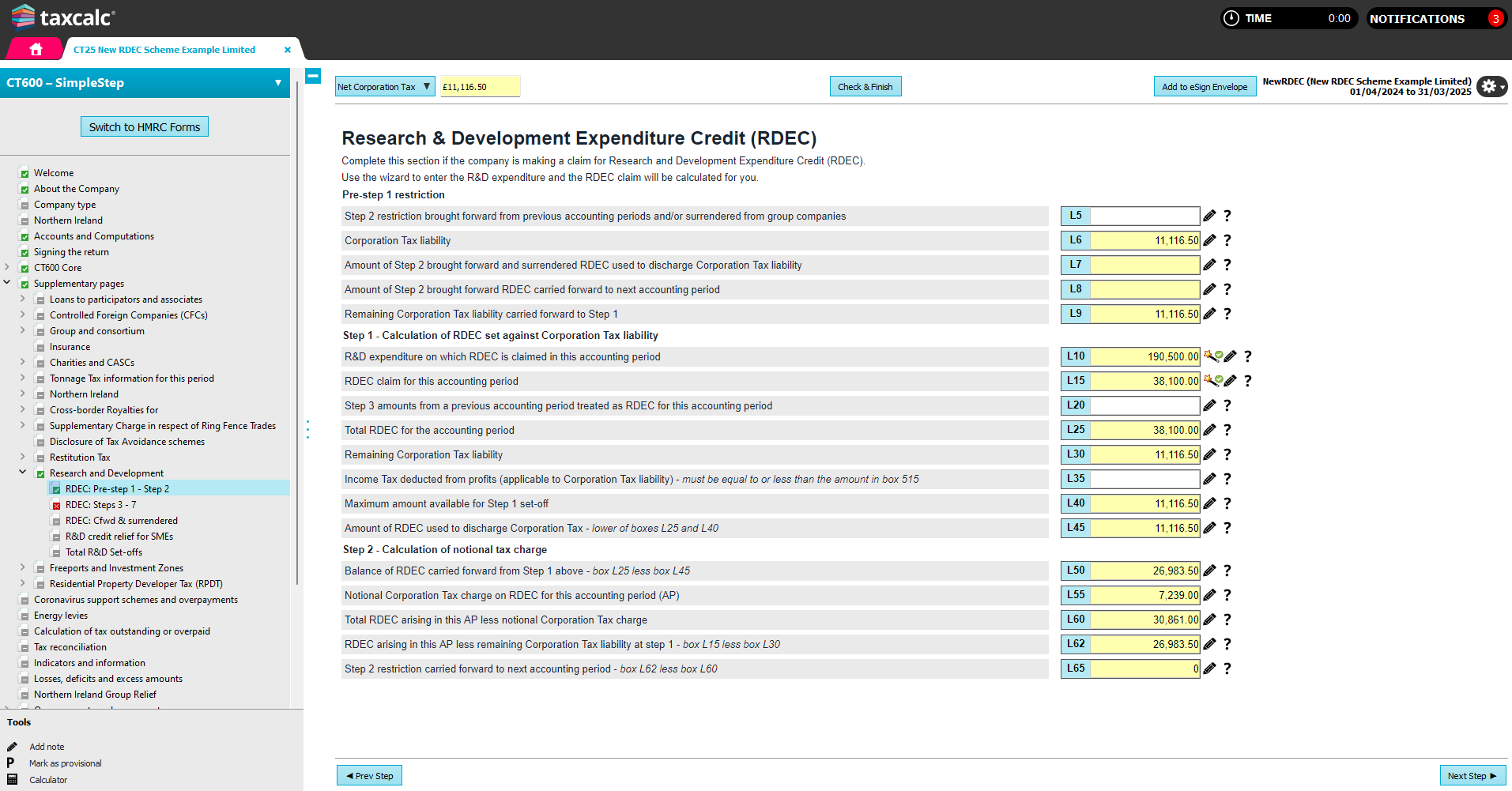

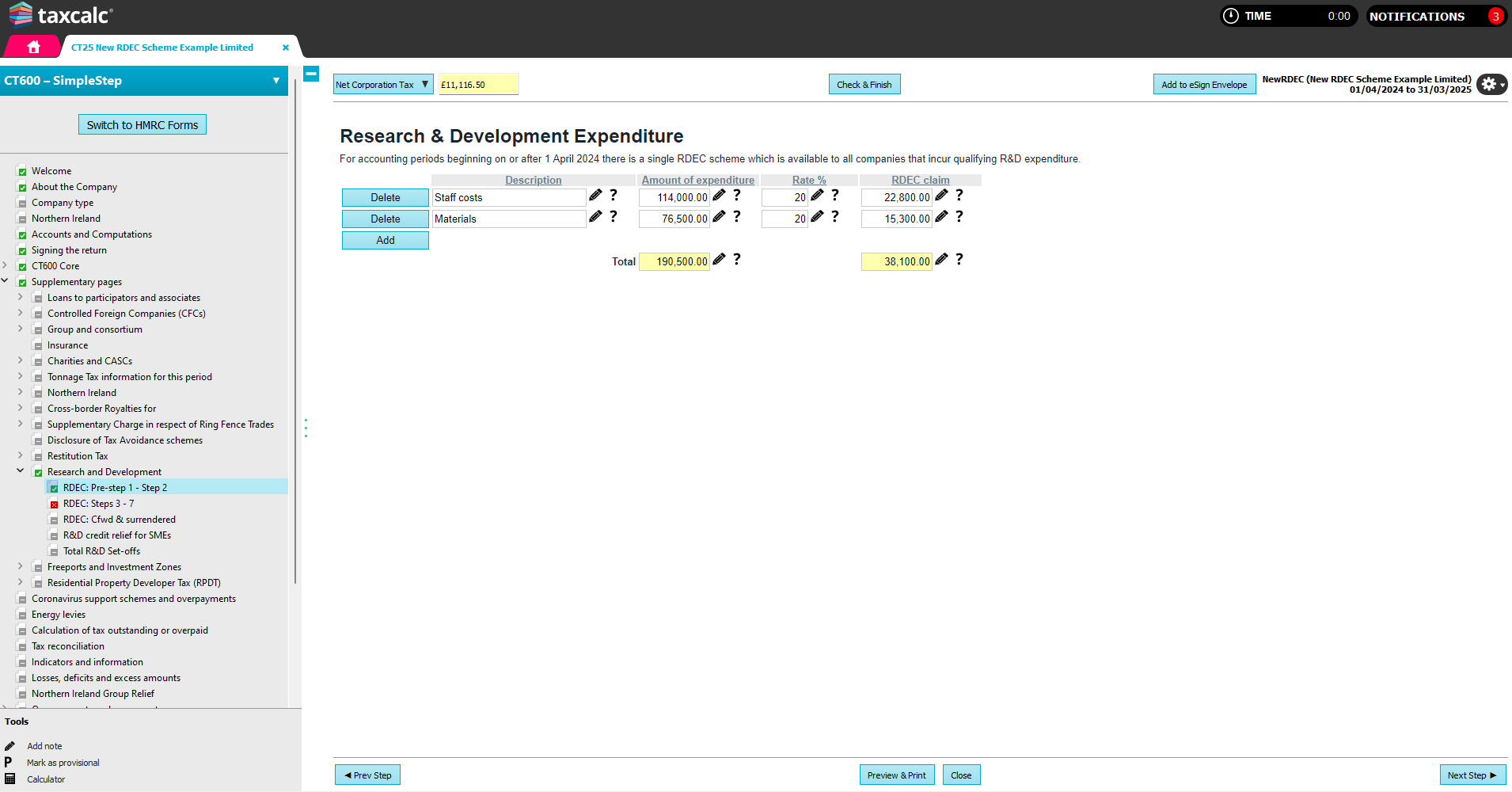

How to claim RDEC To claim RDEC, complete the Research & Development supplementary pages (CT600L). Enter details of qualifying expenditure using the Research & Development Expenditure wizard which will also calculate the RDEC claim equal to 20% of qualifying expenditure.

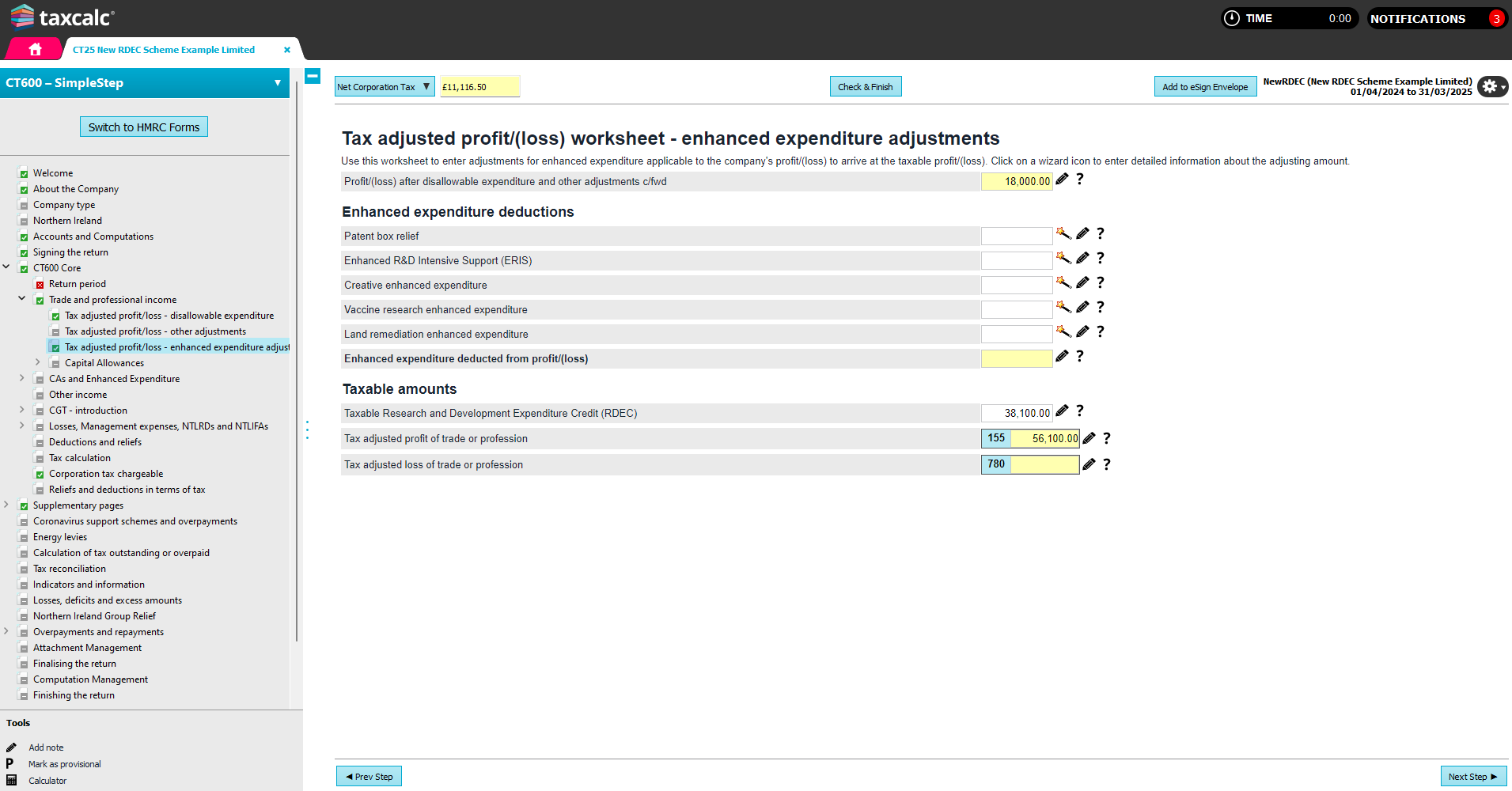

The RDEC amount is an ‘above the line’ expenditure credit, which is taxable trading income of the company. If this amount has already been included in the company’s profit or loss then no further adjustment is required, however if the RDEC has not already been included in the company’s profit or loss then an adjustment should be entered using the Taxable Research and Development Expenditure Credit (RDEC) box on the Tax adjusted profit/loss – enhanced expenditure adjustments screen.

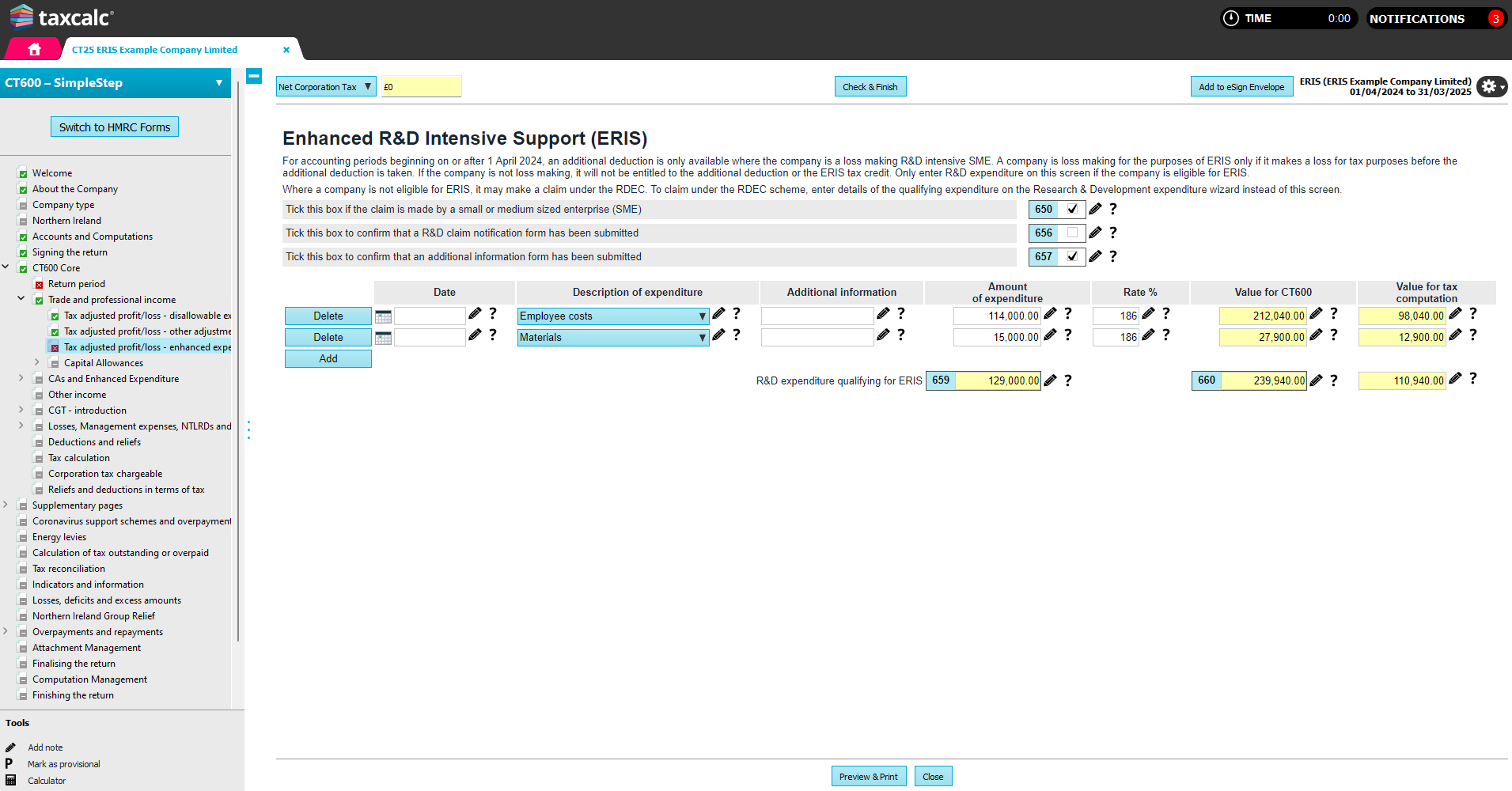

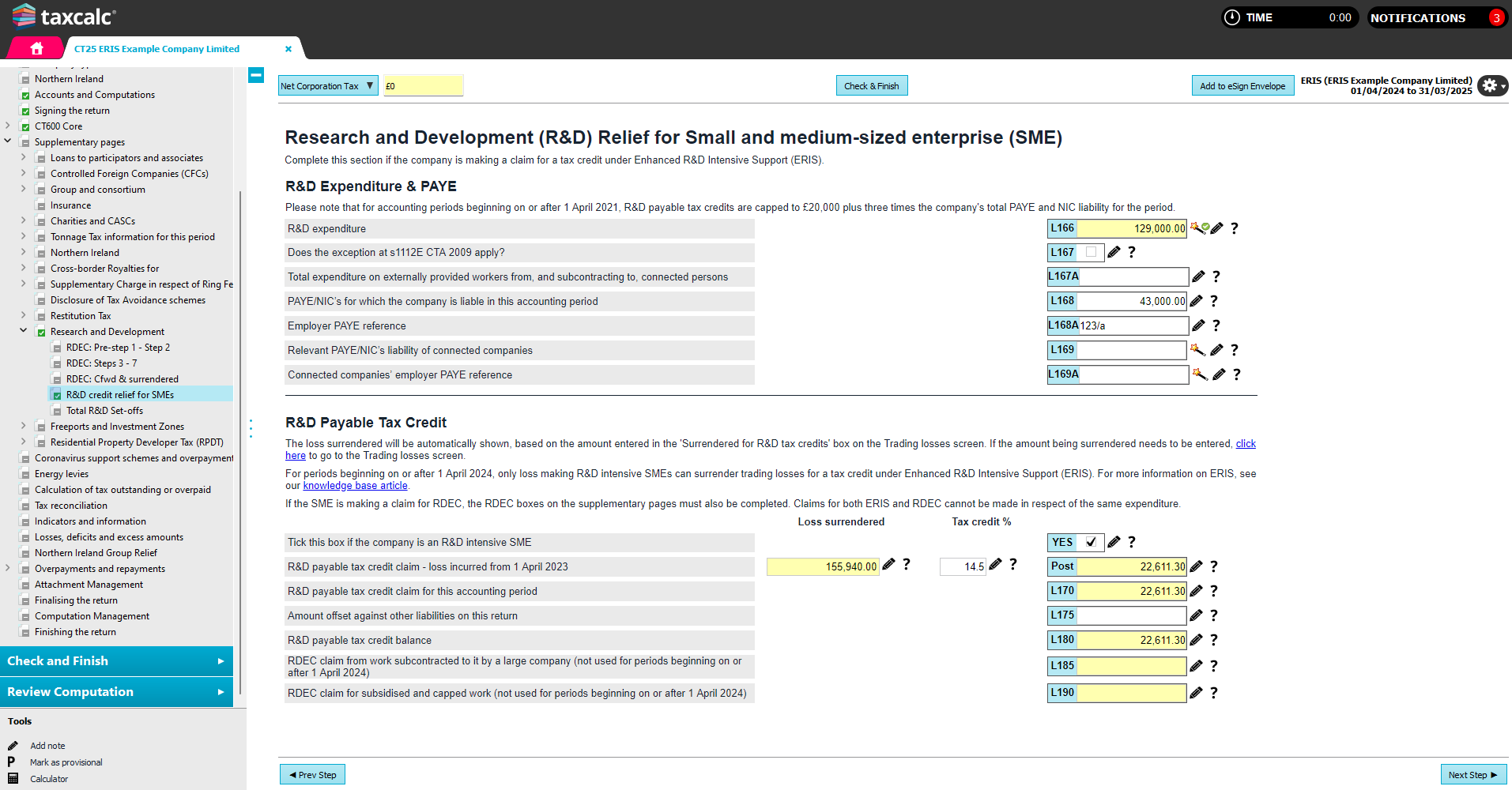

Enhanced R&D Intensive Support (ERIS) Where a company is a loss making R&D intensive SME, it may claim relief under the Enhanced R&D Intensive Support (ERIS) scheme instead of the RDEC. Eligible companies may choose to claim under either RDEC or ERIS. Under ERIS, eligible companies may deduct an extra 86% of qualifying costs in calculating their trading loss and claim a payable tax credit of up to 14.5% of the surrenderable loss. Unlike the RDEC, the payable ERIS tax credit is not taxable. This operates in a similar way to the SME R&D scheme for periods prior to 1 April 2024. To qualify, the company must be a Small or Medium sized enterprise (SME), meet the R&D intensity condition (relevant R&D expenditure is at least 30% of its total relevant expenditure) and incur a loss for tax purposes before the additional deduction is taken. How to claim ERIS 1. Indicate that the company meets the qualifying conditions by selecting the option ‘Tick this box if the company is an R&D intensive SME’ on the R&D credit relief for SMEs screen in Simple step. 2. Enter qualifying R&D expenditure in the Enhanced R&D Intensive Support (ERIS) wizard. The additional 86% deduction will be calculated and deducted in the trading profit calculation.

3. Enter the loss to be surrendered as ‘Surrendered for R&D tax credits’ on the Trading losses screen. The maximum loss that can be surrendered is the lower of the remaining trading loss available and the total enhanced R&D expenditure. 4. Ensure that the relevant details are completed on the Research and Development (R&D) for Small and medium-sized enterprises (SME) section of the Research and Development supplementary pages (Page 4 of the CT600L or the R&D credit relief for SMEs screen in Simple step).

This article was:

|

||||||||||