|

Article ID: 3332

Last updated: 03 Jun, 2025

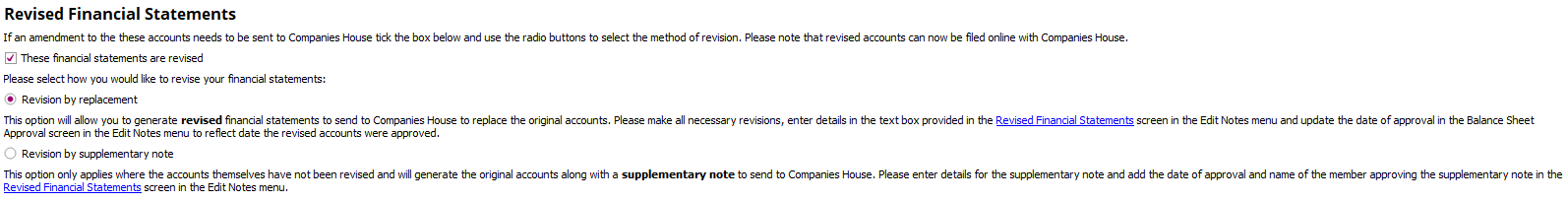

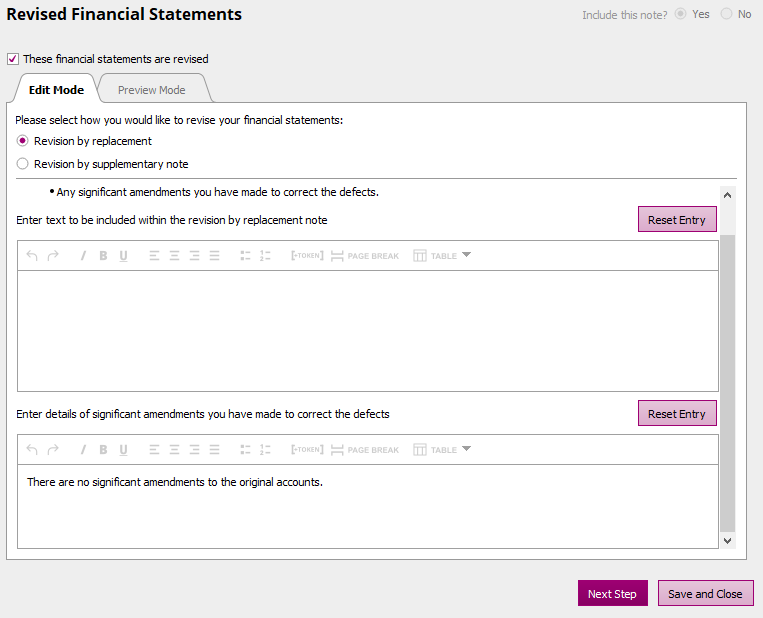

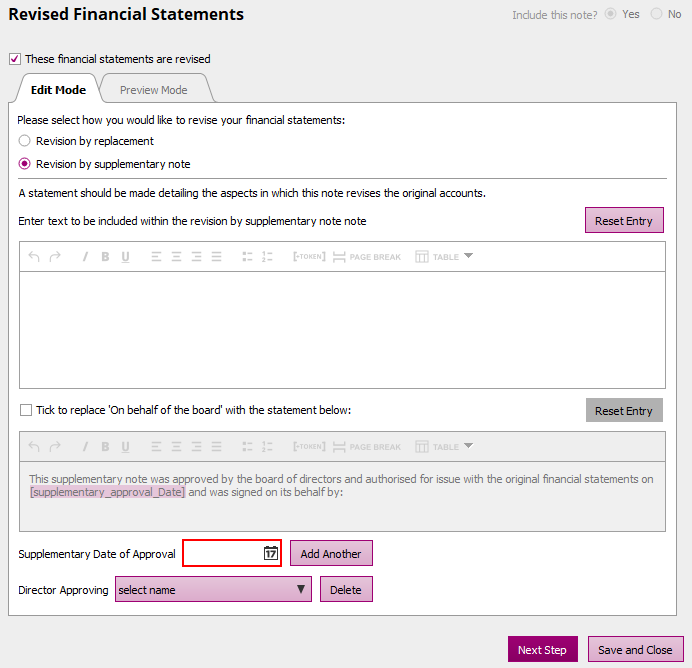

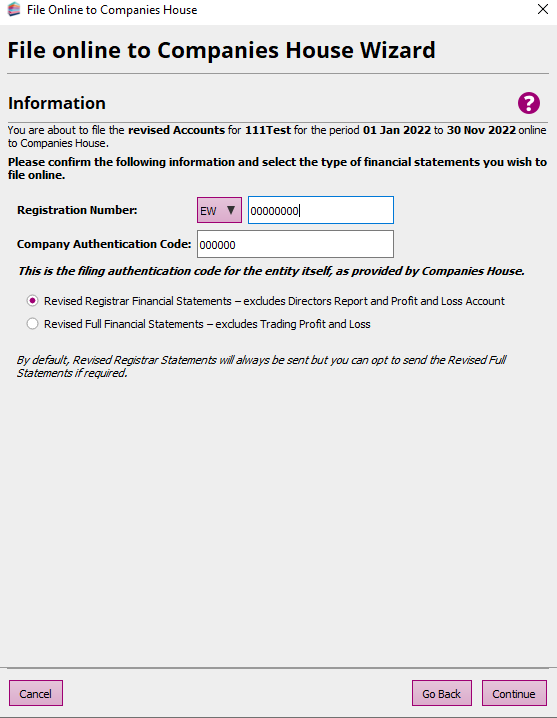

From version 13.6.003 of TaxCalc, we introduced the option to submit Revised Financial Statements electronically for periods ended on or after 1 April 2022. From version 14.5.XXX, a further change has been introduced to submit Revised Financial Statements electronically for periods ended on or before 31 March 2022. The instructions will take you through the process of submitting revised accounts electronically: Accounts Setup > Accounts Presentation > Financial Statements > Tick These financial statements are revised You will then need to determine whether the accounts fall under Revision by replacement or Revision by supplementary note, both options also include a definition to assist in selecting the correct option. Once you have selected the appropriate type of revision you can click on the blue hyperlink to complete the note, alternatively go to Notes > Edit Notes > Revised Financial Statements Revision by replacement:The first box must include relevant details. The second box will automatically state that there are no significant amendments, however if this isn't true the wording will need to be removed and further information must be provided. The Balance Sheet approval needs to be updated with the revised approval date. Please note: If any of these steps are skipped the submission will be rejected. Revision by supplementary note:The first box must include relevant details. You will also need to include the date of approval and select the Directors / Member approving. Please note: If any of these steps are skipped the submission will be rejected. Once you are ready to submit your revised financial statements go to Check and Finish > File to Companies House, at this point you should have the option to submit Revised Registrar Financial Statements or Revised Full Financial Statements.

This article was:

|

||||||||||||