|

Article ID: 3297

Last updated: 14 Mar, 2023

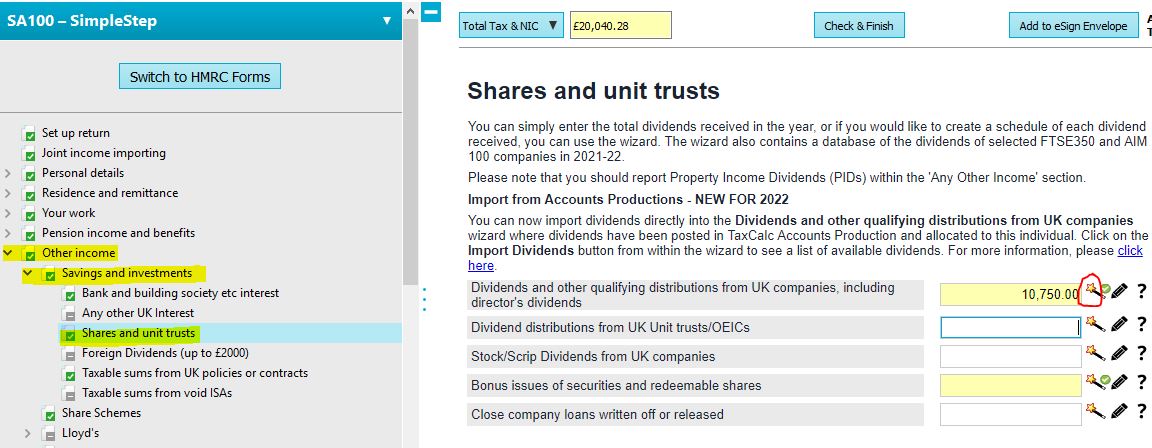

How can I import director dividends from the company accounts into a tax return (SA100)?Dividend information for directors' individual tax returns can be viewed and selected within the tax return, rather than searching for the amounts separately in Accounts Production. This functionality relies on a relationship existing between the company and the director, so that the director is displayed as an officer within the accounts. In addition, you will need to ensure that the directors dividends postings have been allocated to a director within the Postings screen. Creating a relationship between the director and the companyThe relationship can be created in the client record (Relationships) or in Accounts Production as follows: Open a client accounting period > Client information > Officers

Allocating a director to dividend postings in Accounts ProductionA director name can be allocated during entry of the transactions or by editing the posting batch: Accounts Production > Posting

* If no directors appear in the dropdown, the relationship has not been set up- see above. SA100 importing dividendsOpen the SA100 for the director and In SimpleStep:

In HMRC Forms The same functionality can be found in SA100 Core > Page 3 > Box 4 Dividends from UK companies * The default transaction date in Accounts Production is the period end date. There may be dividend transactions entered using the default date but were actually paid before this date. We recommend using the actual transaction date for dividends, where possible, for clarity with which transactions should be included within the tax year.

This article was:

|

||||||||||||||||