|

Article ID: 3172

Last updated: 09 Jun, 2021

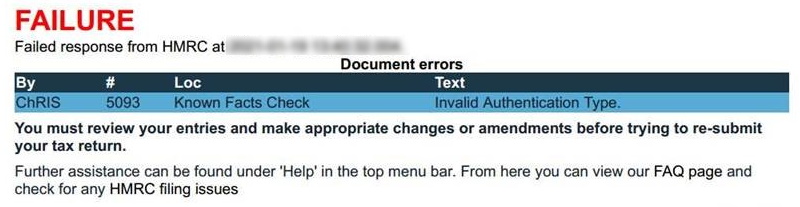

When you receive the 5093 error message, this is because the UTR details entered when attempting to file are incorrect, or they do not match what HMRC are expecting. This message is sent directly from HMRC as the portal does not recognise the UTR for the chosen service.

This error is common when trying to file an SA800 Partnership return and tends to reflect an error with the UTR being used to file the return (e.g. the partner's UTR has been used incorrectly). When you file to HMRC, the first check will be your User ID and password, and any valid UTR on HMRC's records. Once this has been completed, the return will then go through a secondary check where the UTR linked to the return is cross checked for the right service. For example, if you are filing a Partnership return, HMRC will check that this UTR is linked to a Partnership. If the UTR is not linked to a Partnership UTR, then the 5093 error message will be flagged. Agent: If you have a 64-8 in place

Non-agent or no 64-8 in placeThe UTR will need to be verified by a written copy of correspondence issued from HMRC. Once you have verified the UTR, we would recommend removing and re-entering the UTRs present on the return before re-attempting submission. If the error persists and you believe the details entered in TaxCalc match what HMRC are expecting, you would need to contact HMRC Online Services to discuss the situation further.

This article was:

|