|

Article ID: 2513

Last updated: 06 Mar, 2025

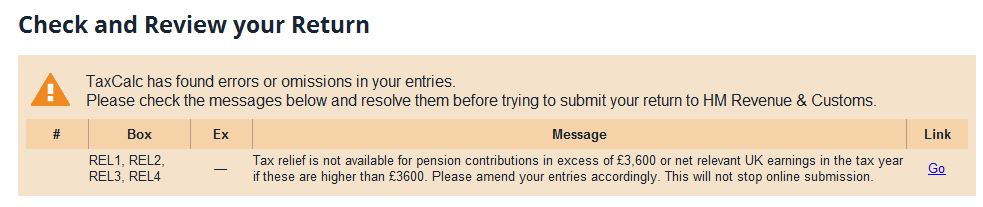

The pension contribution amount, on which tax relief is available, is restricted to the amount of the taxpayer's relevant UK earnings within the tax year (or £3,600 in the absence of income). If pension contributions have been entered within the return and exceed the amount of relevant UK income earned, the following Check and Finish message will appear: What action should I take in TaxCalc?

¹ the limit of relevant UK earnings is limited to those earnings arising in the current year; there is no brought forward, unlike the annual allowance cap. The annual allowance is a separate cap when the relevant UK earnings exceed this allowance ² whilst no additional tax relief will be claimed on the return, HMRC may claw back excess tax relief provided at source by the pension provider The sections below explain more about tax relief available for pension contributions, the way in which relief is given and what constitutes relevant UK earnings. Relief at source methodIn most cases, with the exception of retirement annuity contracts, tax relief on contributions is obtained by using the relief at source method. Where this is the case, contributions are deemed to have been made net of 20% basic rate tax. The scheme administrator is then able to claim the relevant rate of tax from HMRC to be added to the pension fund. For example, if pension contributions of £800 are paid to a pension fund, where the relief at source method is used, the payment is deemed to be net of 20% tax (in this case basic rate tax of £200). The pension scheme administrator claims the £200 from HMRC and adds this to the fund so that in total the gross contribution to the fund is therefore £1,000. For higher rate taxpayers, additional relief is obtained through the tax return by entering the gross contributions in box 1 on page 4 of the tax return. The basic rate band is then extended by the gross amount so that less income is taxed at higher rate, with the effect that relief is given for the difference between the higher rate and basic rate. The maximum amount of gross contributions that an individual can claim relief for in a tax year is the higher of;

For these purposes ‘Relevant UK earnings’ are defined in s189 Finance Act 2004 and are also explained in HMRC’s Pension Tax Manual https://www.gov.uk/hmrc-internal-manuals/pensions-tax-manual/ptm044100#earnings . This comprises the following items;

Unlike the annual pensions allowance, the earnings limit can only comprise income from the relevant tax year, and no ‘excess’ is carried forward from previous years. Where pension contributions have been made that exceed the maximum amount, it is important that you contact your pension scheme administrator as they will need to take action in order to ensure that the tax claimed from HMRC is adjusted as required. They will also advise you whether any excess contributions can be retained in the fund or will be returned to you. You should ensure that the value in box 1 on page 4 of the tax return is the gross amount on which tax relief can be claimed, which may need to be restricted if the contributions originally made were in excess of the maximum amount. Where relief at source is not operatedWhere relief at source is not operated, relief is obtained through your tax return by entering the amounts in the relevant box (2, 3 or 4) on page 4 of the tax return. The maximum amount of relief that can be claimed in a tax year is restricted to the amount of the individual’s relevant UK earnings (as per the definition above). Note that, in contrast to the relief at source method, there is no minimum £3,600 ‘basic amount’ available, therefore no relief is available if there are no relevant UK earnings for the tax year.

This article was:

|

||||||||||||||||