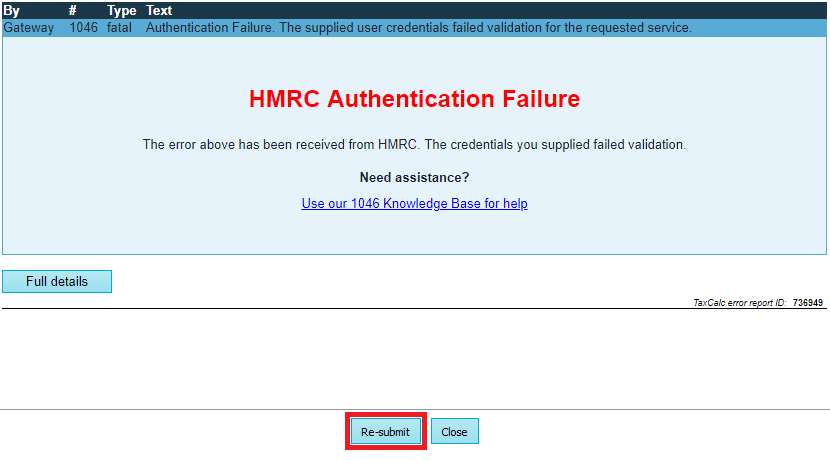

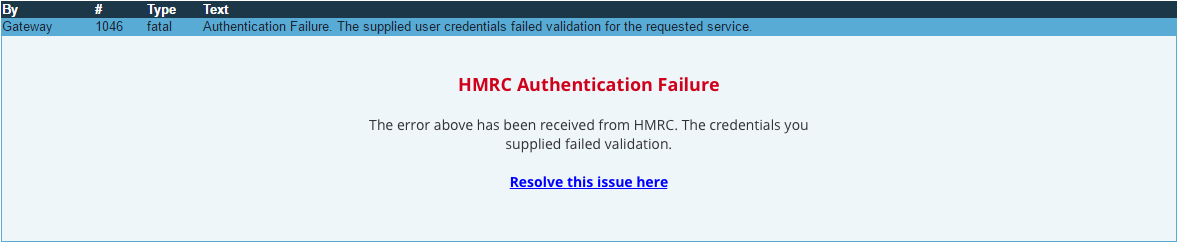

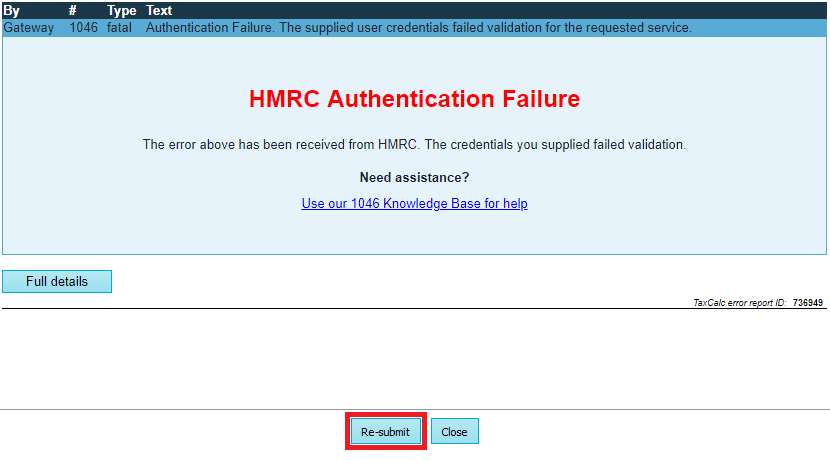

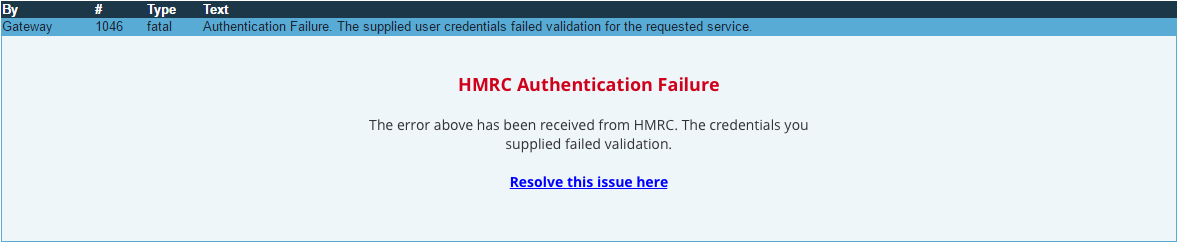

What is a 1046 authentication error?

When you receive a 1046 error message in TaxCalc (as shown above) after attempting to file tax return, it will be due to one of the following:

- HMRC do not recognise the filing credentials ( government gateway account user ID and password) which are entered in TaxCalc prior to the submission attempt.

- There is a block on your HMRC account.

- This can happen if you have attempted to file a number of times with a failure (if you try 3-5 times in quick succession this locks your account for 2 hours)

- Your UTR has been disabled or blocked from allowing online submissions.

To resolve this error, please see the links below for written instructions based on your scenario, or download our PDF step by step guide which illustrates the steps required in a flow chart.

I am an agent trying to file a client’s tax return

I am trying to file an individual tax return (SA100) for myself or friends and family

I am trying to file a partnership tax return (SA800) for myself or friends and family

I am trying to file a trust tax return (SA900) for myself or friends and family

I am trying to file a limited company tax return (CT600) for myself or friends and family

To re-submit the return after any required changes have been made to the return you can go to Check and Finish > File Tax Return online to HMRC > Re-submit at the bottom of the page > Submit.