|

Article ID: 834

Last updated: 05 Dec, 2024

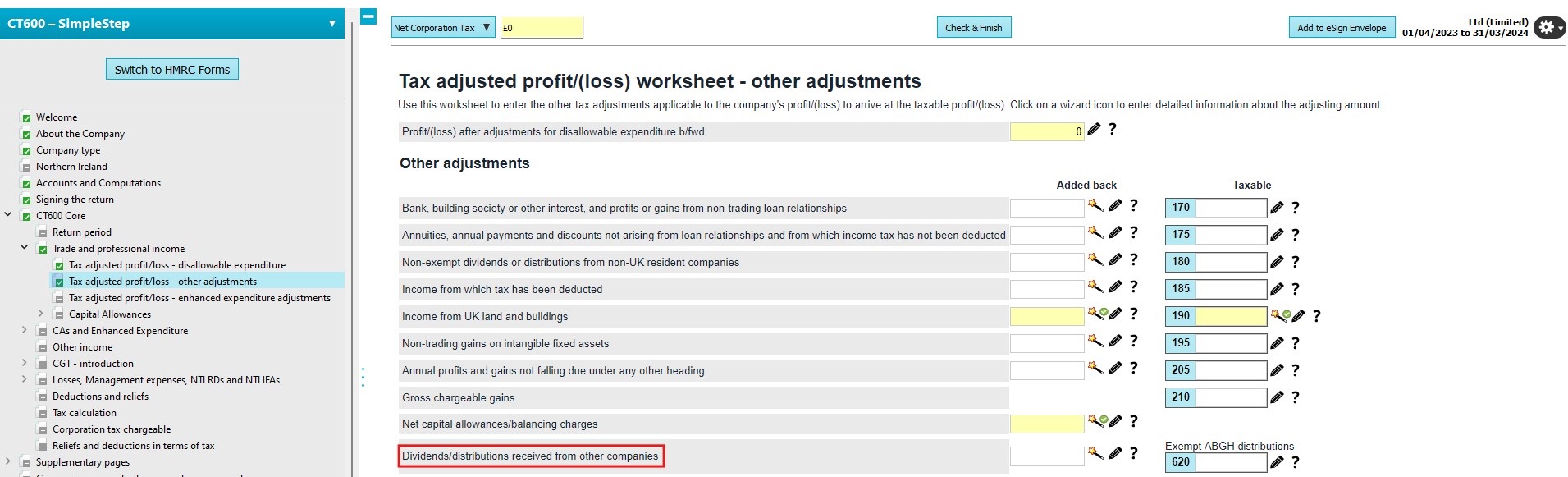

The treatment of dividend income received and where this information should be declared on the corporation tax return will depend on whether certain criteria is met (as laid out in the legislation here) which confirms some dividends/distributions are chargeable to corporation tax whilst others are exempt. Further information on exempt dividends/distributions can also be located within the CT600 guide here, specifically under text relating to box 620. From the winter update (version 16.1.200), if you are using Accounts Production and have dividend income within your postings, we recommend reviewing the information as per our knowledge base article here. In order to know how to declare the exempt dividend income/ distributions received within TaxCalc, you will firstly need to verify if the income has been included within the accounts and therefore the starting profit figure. Income is within accountsSimpleStep mode:Browse to CT600 Core > Trade and Professional income > Tax adjusted profit/(loss)worksheet – other adjustments. The profit/loss value shown at the top of the page should contain the exempt value which needs to be removed. Enter the value into the row labelled 'Dividends/distributions received from other companies' which will reduce the profits being charged to corporation tax. Please note box 620 will populate with the same value but depending on whether this amount was received from a group company or not, may mean this entry is not required. You should review this entry as needed.

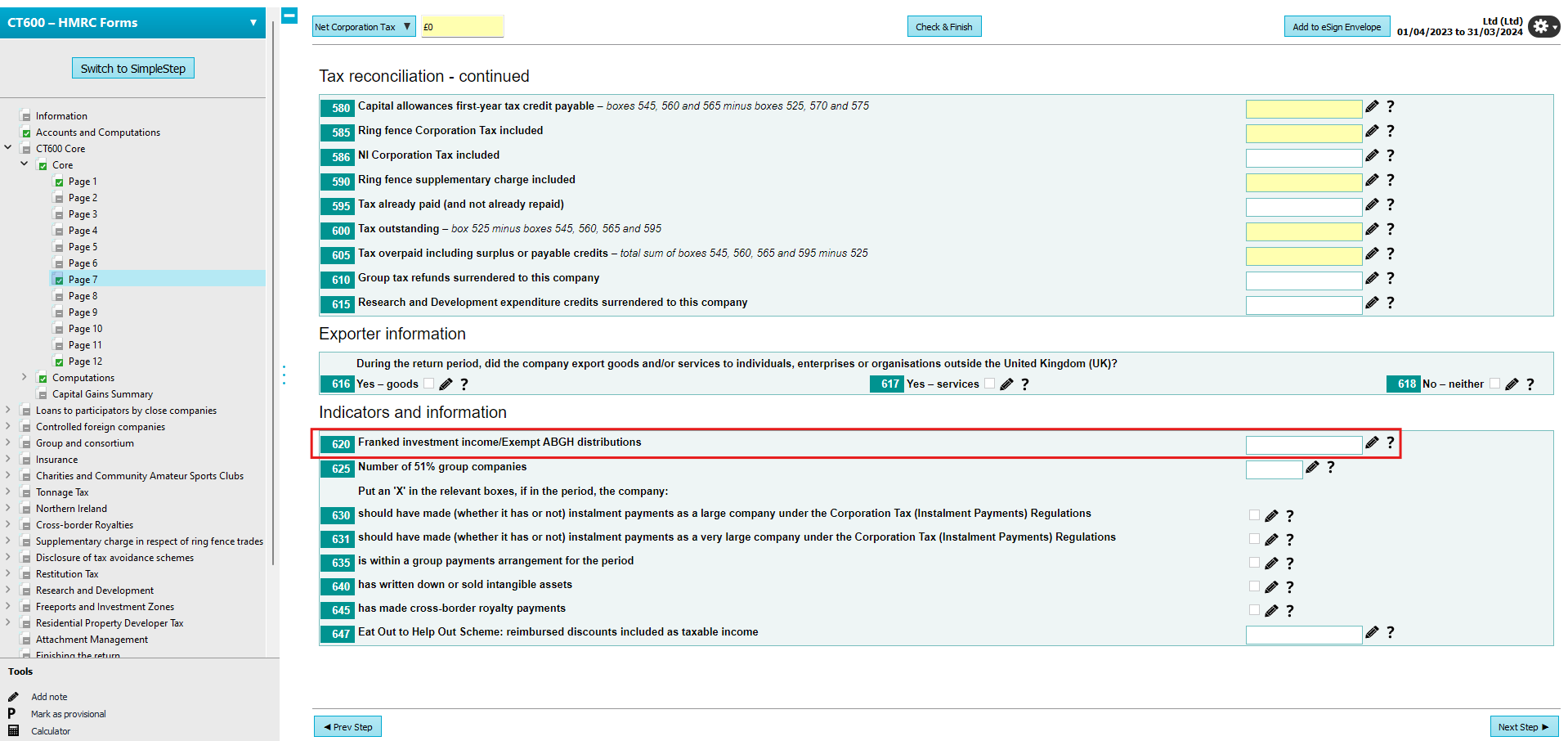

Note if the return period starts on or before 31/03/2016, the row shown will be labelled 'Net dividends received from other companies' HMRC Forms mode:Browse to CT600 Core > Computations > Tax adjusted profit/(loss)worksheet – other adjustments. The profit/loss value shown at the top of the page should contain the exempt value which needs to be removed. Enter the value into the row labelled 'Dividends/distributions received from other companies' which will reduce the profits being charged to corporation tax. Please note box 620 will populate with the same value but depending on whether this amount was received from a group company or not, may mean this entry is not required. You should review this entry as needed. Note if the return period starts on or before 31/03/2016, the row shown will be labelled 'Net dividends received from other companies' Income is NOT in accountsSimpleStep mode:As there is no adjustment needed to the trading position, you will simply need to declare the required value in box 620. Browse to CT600 Core > Trade and Professional income > Tax adjusted profit/(loss)worksheet – other adjustments. If there are any trading profits/losses, the value shown at the top of the page should not contain the exempt value. Enter the value into box 620 which appears on the row labelled 'Dividends/distributions received from other companies'. Please note if the return period starts on or before 31/03/2016, the row shown will be labelled 'Net dividends received from other companies' HMRC Forms mode:As there is no adjustment needed to the trading position, you will simply need to declare the required value in box 620. Browse to CT600 Core > Core > Page 7 and enter the value into box 620 which appears on the row labelled 'Enter the value into box 620 which appears on the row labelled 'Franked investment income/Exempt ABGH distributions'.

This article was:

|

||||||||||||||||