|

Article ID: 828

Last updated: 04 Mar, 2026

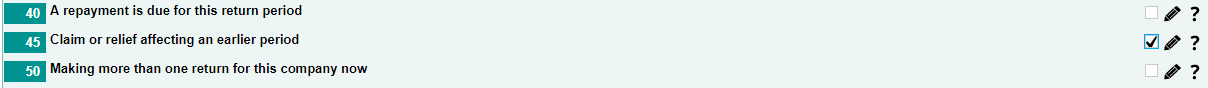

Carrying back company trading lossesA company incurring a trading loss in an accounting period can make a claim to offset the loss against total profits of the previous 12 months after first having set the losses against any profits of the accounting period in which the loss occurred. The amount of trading losses that can be carried back to the preceding year remains unlimited for companies. If the company has ceased trading, there are further requirements for Claiming Terminal loss Relief. How to claim loss relief on a CT600HMRC claims that as long as box 45 for 'Claim or relief affecting an earlier period' is ticked on the current year return, and the computations contain details of the loss being carried back, you should not need to re-file the amendment for the earlier year. This being said, customers have previously reported that although these have been completed, the repayment has not been issued and therefore an amendment of the earlier year, or a follow up letter was required to progress the repayment. How you make the claim will depend on how far back you wish to carry back the loss. For more information on timescales of filing amendments, please see the article for What tax years can I file online? Entries to make for the current return period in which the losses have arisen (V3 form 2023)HMRC Forms Mode:

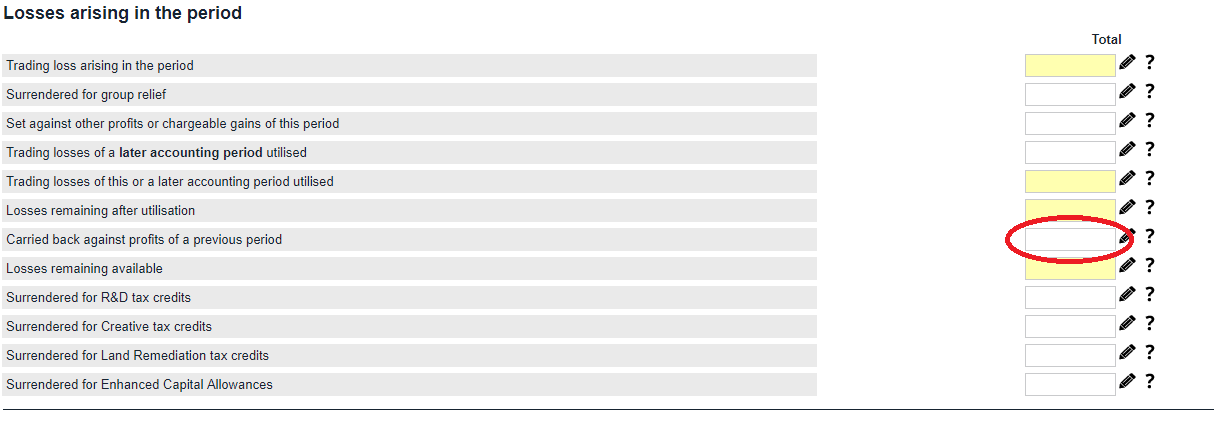

2. Go to CT600 Core > Computations > Losses, Management Expenses, NTLRDs and NTLIFAs >Trading Losses > Insert the loss in the box for ‘‘Carried back against profits of a previous period’’

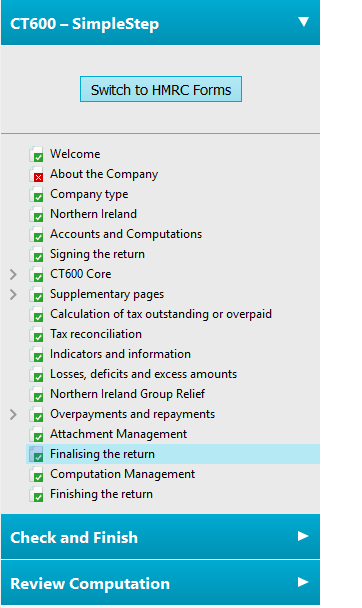

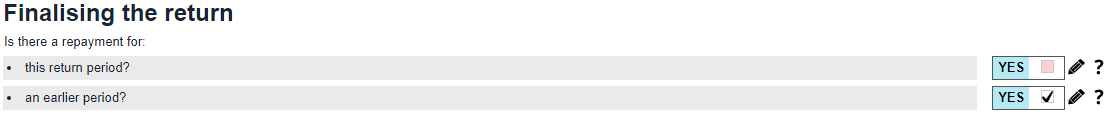

This will ensure the loss amount to carry back is included in the computations, as required by HMRC. SimpleStep Mode:1. Go to Finalising the return 2.Tick the box for an earlier period

3. Go to CT600 Core > Losses, Management expenses, NTLRDs and NTLIFAs > Trading losses. Insert the loss in the box for ‘‘Carried back against profits of a previous period’’. The screen appears as it does for HMRC mode shown above. Please note: Once these entries are completed, you may then process the current period submission as usual. In theory, this should satisfy HMRC requirements as explained but you may wish to send more information to ensure the claim is processed correctly. If the period being amended for the losses being carried back, falls outside of the amended return online filing window, you may still amend the return to send to HMRC as a paper return, alternatively, you can write to them with the details of the loss, (explained at the end of this article). If you would like to process an amendment for the earlier year, please complete the entries as described below. Instructions are given for version 3 of the CT600, relevant for periods starting on or after 1 April 2015. Entries to make for the previous year return period(s) in which loss relief is being claimed:HMRC Forms mode (Version 3)

Simple Step mode (Version 3)

Alternative to sending an amended paper return if the filing window has closedIf the window for amendment of the previous return has closed, (In excess of 12 months after the filing deadline) you can write to your company's Corporation Tax office including the below:

For further information, please the HMRC claiming a loss.

This article was:

|

||||||||||