|

Article ID: 3299

Last updated: 11 Apr, 2023

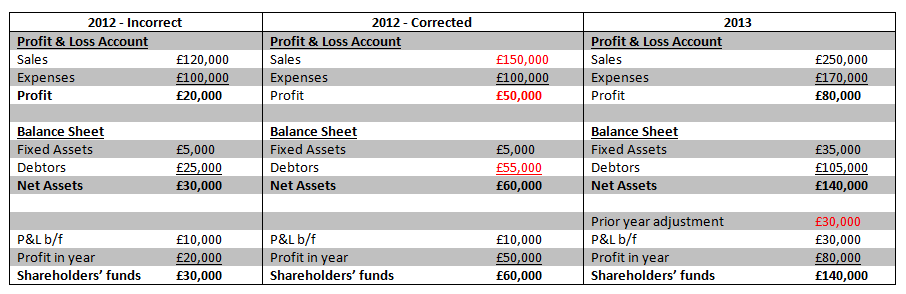

When making a prior year adjustment, you need to ensure that the adjustment is complete in the previous and current year in a particular way to ensure that this files successfully with HMRC and Companies House. You should follow the below routine. Please note: The below instructions are for Profit and Loss related adjustments only, for Balance Sheet adjustments see How do I make adjustments to prior years? - Balance Sheet

By doing the above, this means that you will not have to re-submit the previous year’s accounts as a correction and will also mean that the correction is implemented in the current year’s accounts so that you don’t have to account for this adjustment in future. We hope that the below worked example provides you with some additional clarification.

Final Trial Balance Method

Transactional Method

Computational Adjustments After you've finished your Prior Year Adjustment you should consider whether any tax adjustments are required for the CT600. Usually when making a Prior Year Adjustment to the Profit and Loss account, this will require an increase / decrease to the currents years tax liability. Increase to tax liabilityFor adjustments which increase the tax liability you should navigate to the Tax adjusted profit/(loss) worksheet - disallowable expenditure > *Click* on the wand next to Other expenditure not analysed above > Enter 'Prior Year Adjustment' in the description box and insert the amount in the 'Disallowed' box. Decrease to tax liabilityFor adjustments which decrease the tax liability you should navigate to the Tax adjusted profit/(loss) worksheet - other adjustments > *Click* on the wand next to Miscellaneous other deduction > Enter 'Prior Year Adjustment' in the description box and insert the amount in the 'Added back' box.

This article was:

|

||||||||||||||||||