|

Article ID: 1229

Last updated: 24 Mar, 2021

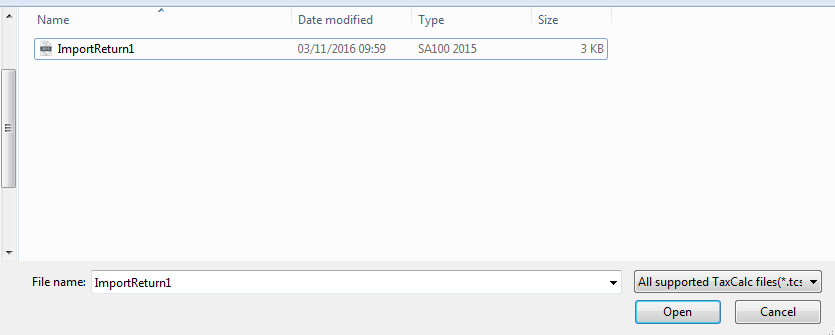

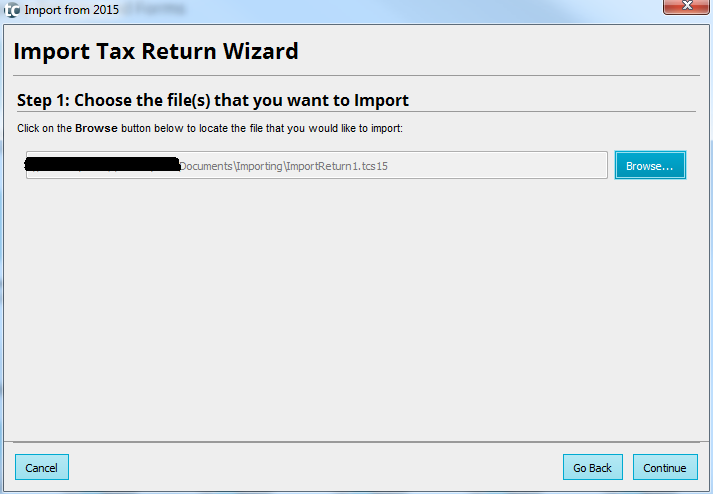

Depending on whether you are looking to import a single tax return file or multiple tax return files, the instructions will vary. Below are 2 videos, the first for importing multiple tax returns and the second for single file. Video 1 - Multiple tax return files Video 2 - Single tax return file Please see the written instructions below: To import your previous year's tax return data into the current year version of TaxCalc, you will need to:

The current year's return will now be created with the data from the previous year's tax return and you can fill in the return as normal.

This article was:

|

||||||||||||||||||||||