|

Article ID: 2881

Last updated: 01 Aug, 2019

The 403 error message is broken in to two parts.

If you are receiving the 403 error (Client or Agent not authorised), there are multiple reasons this error can be returned but HMRCs investigations have shown that in over 90% of cases the reason is one of the following:

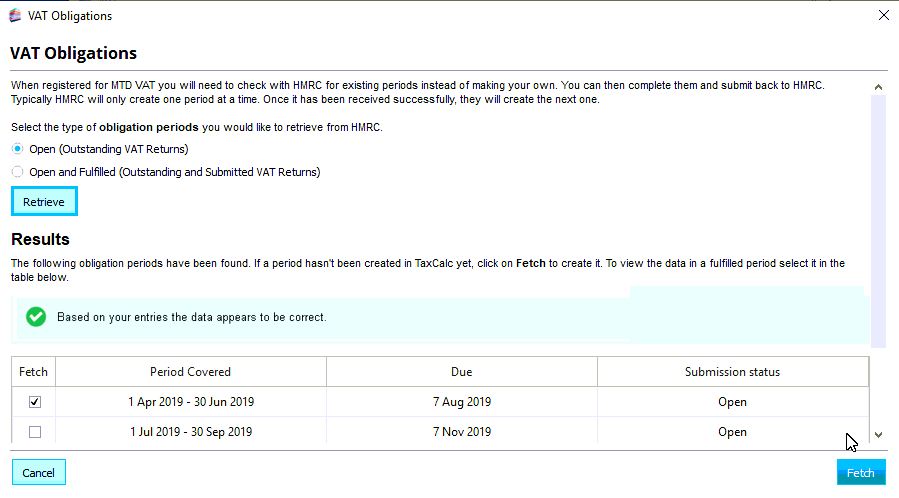

HMRC advise that the best way of resolving this 403 error is by following this guide. If you are receiving the 403 (Forbidden) TAX_PERIOD_NOT_ENDED, this is because during the fetch for open periods, you have selected a future period that has not yet closed. When fetching for open VAT return periods, TaxCalc will display the earliest outstanding obligation first. E.g.

Note HMRC implemented a change on 01/07/2019 to display current and next VAT quarter so this is one to be wary of.

This article was:

|