|

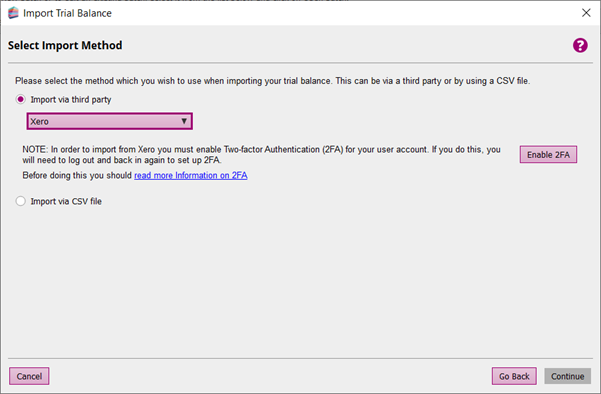

Please note: Xero functionality requires users to be on version 11.16.121 or higher. Please go to Help > About to verify your software version and update as required, to continue to use the integrations with Xero. IntroductionImporting a Xero Trial Balance VideoStep by Step GuideFlow DiagramFrequently Asked QuestionsIntroductionTaxCalc integration process with Xero allows for seamless transition of data. This means a trial balance can be imported directly in to a specified year-end into the Accounts Production module. Importing a Xero Trial Balance VideoMore information on how the functionality works can be found in our video below. Step by Step GuideAlternatively, please see our step by step instructions on how to use this functionality in TaxCalc below. Step 1: Start the import procedureLaunch Accounts Production. Open your client and the accounting period. Select Posting from the left-hand menu. Select Import Trial Balance from the left-hand menu. Step 2: Select Import MethodSelect Xero from the drop down for Import via third party. It is now mandatory to enable Two-factor Authentication when using Xero. If you have not enabled it in Admin Centre, when you go to Accounts Production →Import Trial Balance and select Xero, the following NOTE is displayed:

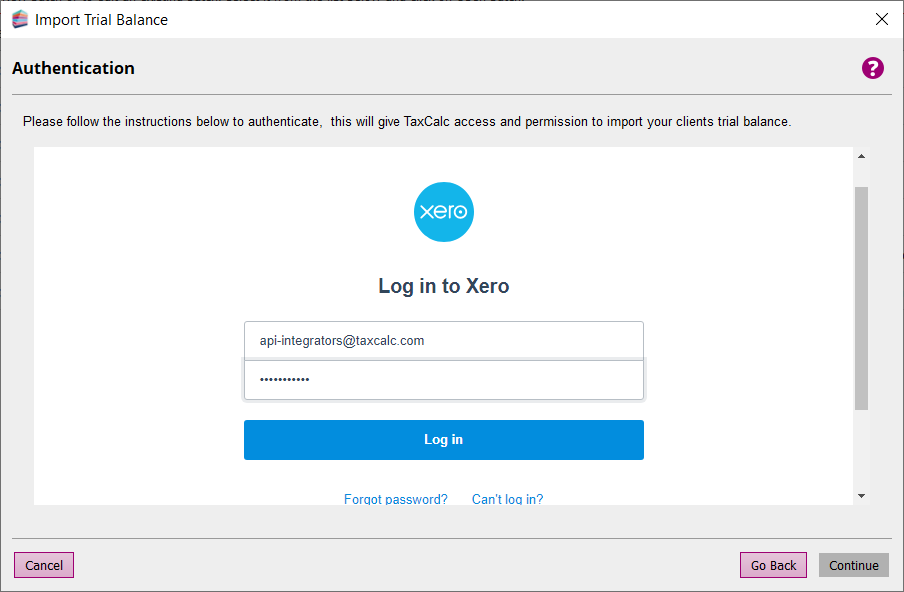

Click Enable 2FA. Then click Cancel, close Accounts Production and log out of TaxCalc and log back in following steps from How to Set Up Two-Factor Authentication (2FA). Step 3: AuthenticationIn order to gain authentication with the third party API, enter your credentials in the authentication window to login, this will allow TaxCalc permission to access and import the trial balance.

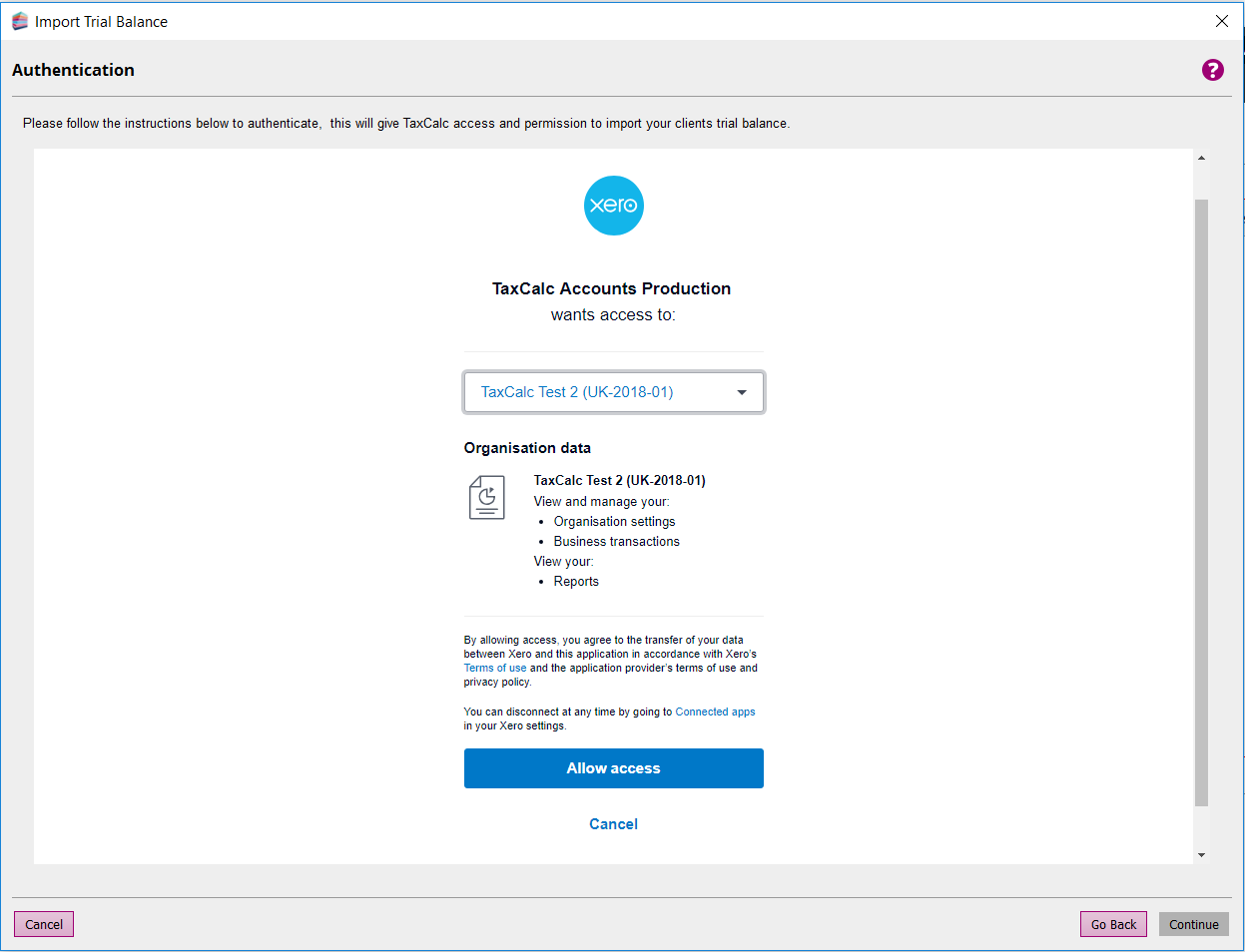

Successful authentication will proceed through to the next step requesting to allow access to Xero. Select Allow access.

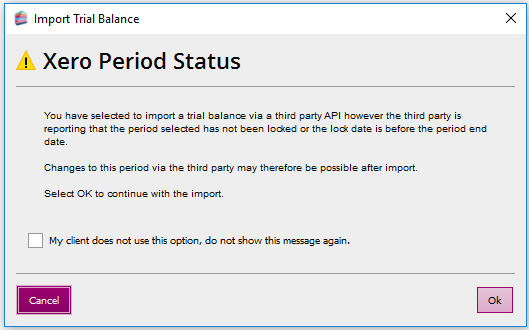

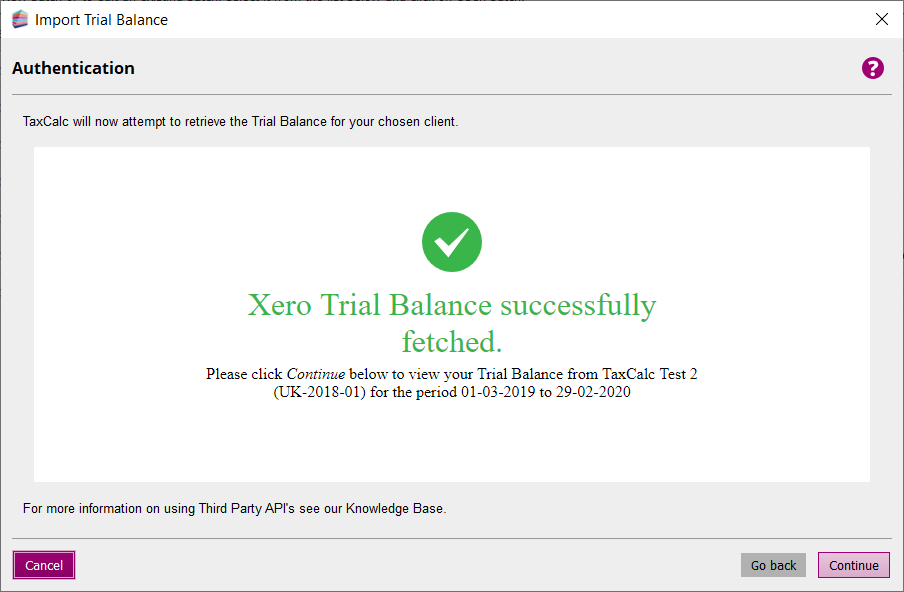

The next screen will confirm the name of the Xero client and the period dates for which the trial balance will be imported for. Click on Continue. If a connection has already been established, you can see the connection status along with an option to disconnect from the Import Trial Balance dialog. Step 4: Xero Period StatusIf the selected period in Xero has not been locked, changes to the period are possible after the import. If your client does not take advantage of this option, tick the box to not show the warning message again. Click on OK.

TaxCalc will now attempt to import the trial balance for your client. Click on Continue.

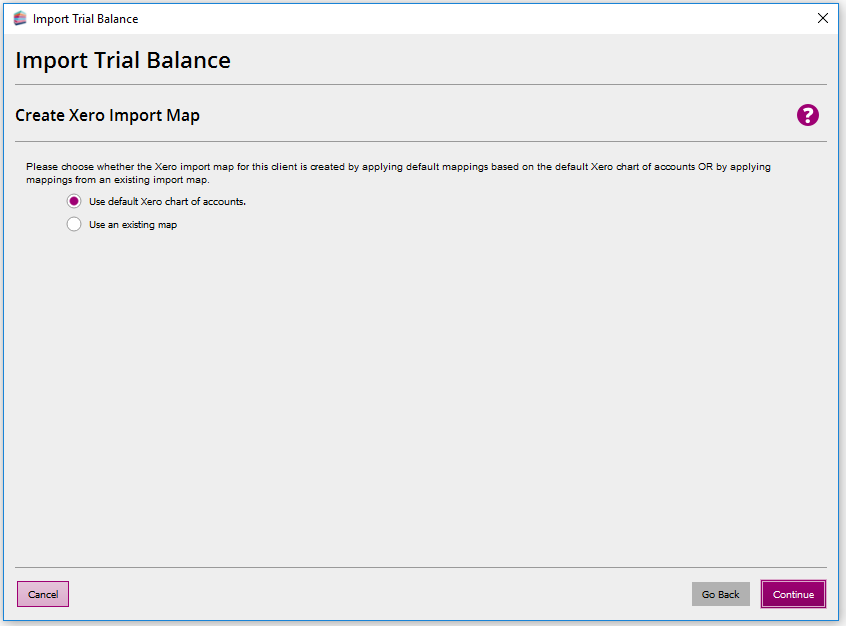

Step 5: Create Xero Import MapThis screen will only appear on first import; you will be presented with two options.

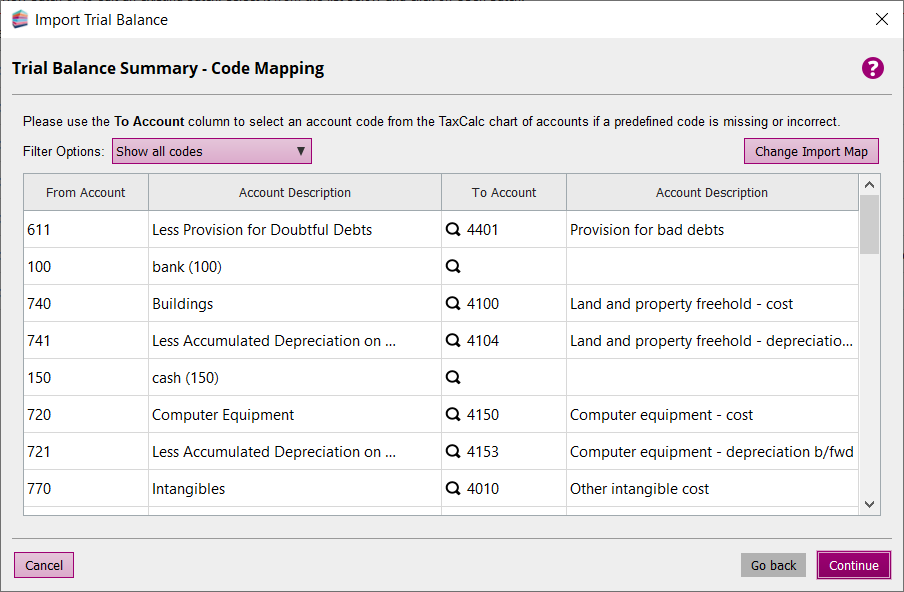

A default set of mappings based on the Xero chart of accounts is available, TaxCalc has mapped as many account codes as possible but some codes may need to be defined manually (which can be applied on the code mapping screen). Should you wish to import the trial balance using an existing map, select from previously created CSV maps and other clients Xero import maps. Click on Continue. Step 6: Trial Balance Summary – Code MappingThe Trial Balance Summary lists all of the unique codes within the import that has been identified and mapped by default along with any codes that has not been mapped by TaxCalc. Using the magnifying glass within the ‘To Account’ column, select the corresponding TaxCalc account code to map any unmapped codes or to amend an account code that is predefined by TaxCalc. Use the filter options to show only the outstanding rows to be mapped by selecting ‘Unmapped codes’. Please note: Any un-mapped values will NOT be imported. Select Change Import Map should you wish to apply an alternative import map from previously created CSV map or another client's Xero import map. You will be provided with the options to override or update. Click on Continue.

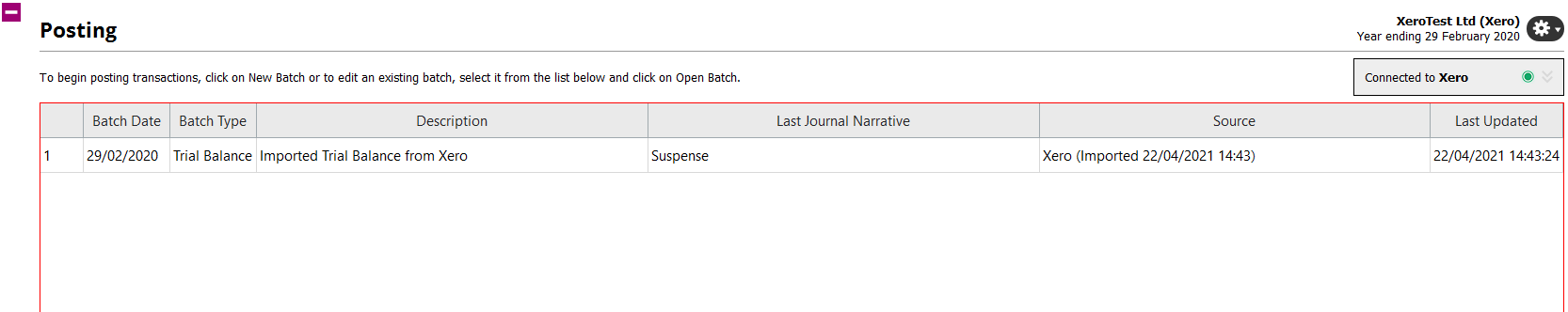

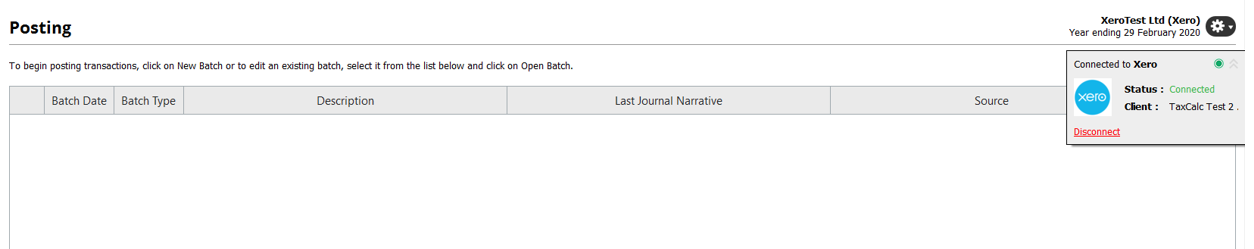

Step 7: Review Data to be ImportedReview the data for the final time that is about to be imported. Click on Continue. You will see in the top right-hand side of the Posting screen that you are now Connected to Xero online. To disconnect, select the down arrow and click Disconnect.

Selecting this box will provide the ability to disconnect the connection to the Xero Client.

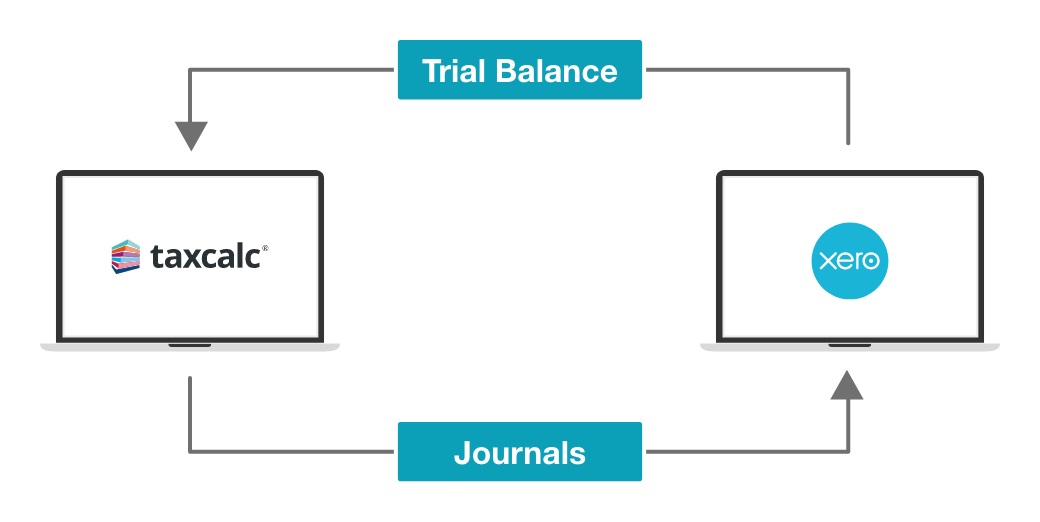

Flow Diagram

Frequently Asked QuestionsFor more information on Xero please see the following Knowledge Base Articles: How do I Import a Trial Balance using third party APIs? How to disconnect from the Xero Client You can also find the import process details in the TaxCalc in-app help: Help →Contents →Introduction to TaxCalc Accounts Production →Posting Transactions →Importing a Trial Balance →Importing a Trial Balance from Xero |