What are the new temporary capital allowances?

From 1 April 2023 until 31 March 2026, companies, who are subject to corporation tax (CT), investing in qualifying, new plant and machinery assets will be able to claim:

- a 100% full expensing first year allowance (FYA) on qualifying plant and machinery asset investments (that would normally qualify for 18% main rate writing down allowances)

- a 50% FYA for qualifying special rate assets (that would normally qualify for 6% main rate writing down allowances)

What are qualifying assets?

Most tangible capital assets used in the course of a business are considered plant and machinery for the purposes of claiming capital allowances. There is not an exhaustive list of plant and machinery assets but HMRC suggest the types of assets which may qualify for either the 100% or the 50% FYA include, but are not limited to:

- Solar panels

- Computer equipment and servers

- Tractors, lorries, vans Ladders, drills, cranes

- Office chairs and desks

- Electric vehicle charge points

- Refrigeration units

Within these types of plant and machinery, some assets are classed as Special Rate assets and can also be pooled together for allowance purposes. These will qualify for the 50% FYA and not 100% FYA. Special rate pool expenditure includes:

- parts of a building considered integral - known as ‘integral features’

- items with a long life

- thermal insulation of buildings

What expenditure is excluded from qualifying?

- Second-hand asset purchases

- Cars (including zero emission)

- Assets used for leasing (if the asset ownership cannot be transferred to the hirer)

- Incurred in a period during which the trading activity changes or ceases

How are the allowances calculated?

The qualifying expenditure is multiplied by either 100% (if it qualifies for the FYA 100%) or 50% (if it qualifies for the special rate FYA) providing the expenditure is incurred before 1 April 2026. As with other capital allowances, these rates will be reduced on a pro-rata basis if the CT period is shorter than 12 months. If the 50% FYA has been claimed, capital allowances can be claimed on the remaining balance in subsequent periods, at the rate of 6%.

How will TaxCalc assist with the calculations?

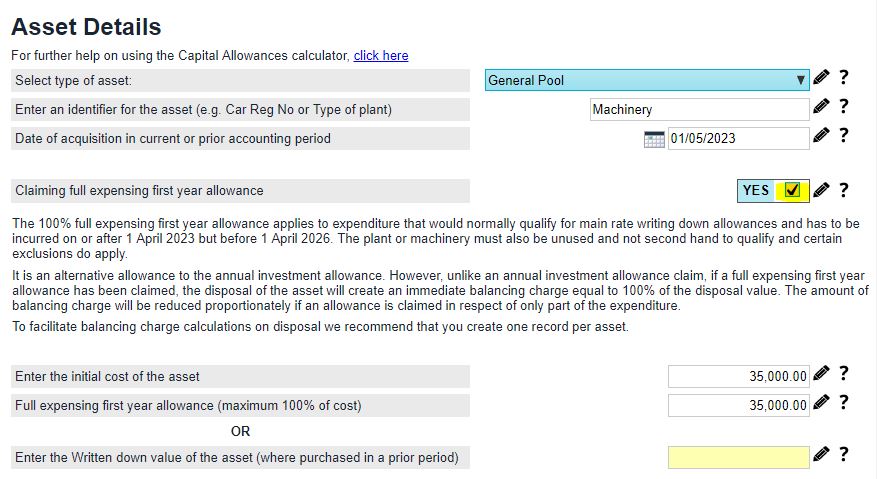

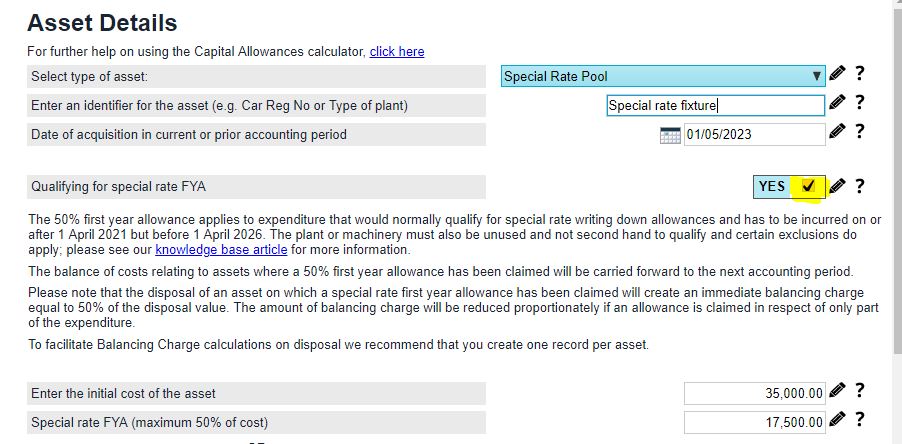

When creating a new asset within the General or Special Rate Pools, TaxCalc provides tick-boxes for you to indicate if the asset qualifies for the full expensing 100% FYA or Special Rate FYA 50%.

When either of these boxes are ticked, the system calculates and populates the allowance available to claim. It is possible to over-write the amounts, if only part of the allowance is being claimed. The remaining balance will be carried forward to the subsequent period within the pool balance carried forward.

What happens on disposal of the asset?

Disposal receipts should be treated as balancing charges (taxable profits), instead of reducing the remaining balances (written down values) on the asset pools. However, if only part of the original expenditure is claimed for either of these temporary allowances then only part of the disposal receipt is treated as a balancing charge (in the same proportion). When using the TaxCalc disposal wizard, the balancing charge calculation will be done automatically, providing the asset was originally ticked for claiming one of the FYAs.